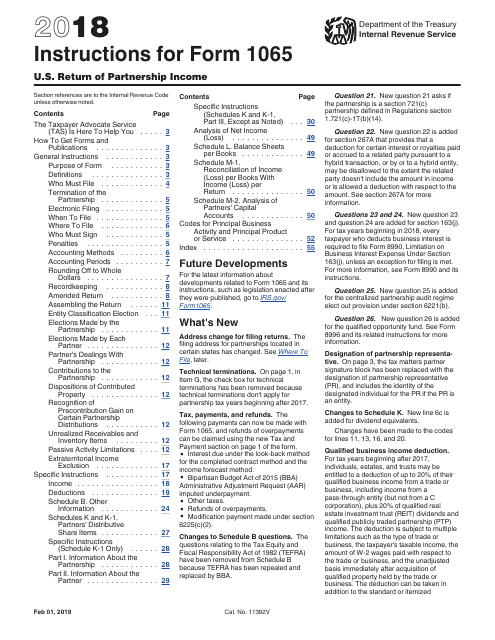

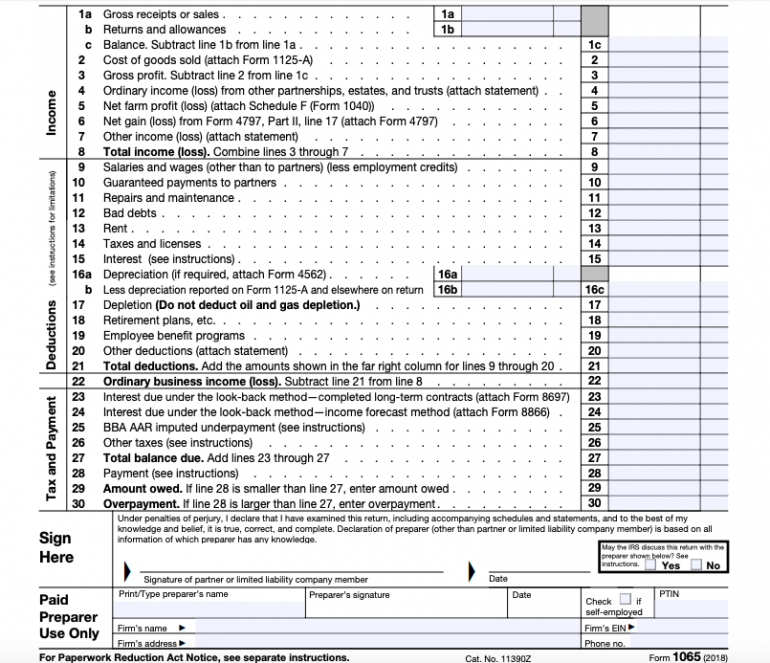

This applies to reporting partner contributions, the partner's share of partnership net income or loss, withdrawals and distributions, and other increases or decreases. Partnerships must use tax basis principles to report the partner's capital account for the 2020 tax year regardless of the method the partnership used previously (e.g., GAAP, IRC Section 704(b)). The IRS added that it did not receive comments on practical alternatives and that limiting reporting to one method makes it easier for the IRS to monitor compliance and minimize examinations of compliant taxpayers. In the announcement on the draft instructions, the IRS said it received numerous comments in response to Notice 2020-43 requesting retention of the "transactional approach" in determining tax basis capital accounts. The Form 1065 draft instructions state that partnerships should calculate each partner's tax basis capital account under the tax basis method for the partnership's tax year using the transactional approach ( i.e., the Transactional Method in Notice 2020-43 ). Partner tax basis capital reporting under draft Form 1065 instructions

Under the Transactional Method, tax capital is maintained by (i) increasing a partner's tax capital account by the amount of money and the tax basis of property contributed by the partner to the partnership (less any liabilities assumed by the partnership or to which the property is subject), as well as allocations of income or gain made by the partnership to the partner, and (ii) decreasing a partner's tax capital account by the amount of money and the tax basis of property distributed by the partnership to the partner (less any liabilities assumed by the partner or to which the property is subject), as well as allocations of loss or deduction made by the partnership to the partner. Notice 2020-43 would have prohibited the use of the "Transactional Method," the method most often used by taxpayers for tracking tax basis capital. Section 1.743-1(d) (Modified Previously Taxed Capital Method) The partner's share of previously taxed capital, as calculated under a modified version of Treas.The partner's basis in its partnership interest, reduced by the partner's allocable share of partnership liabilities, as determined under IRC Section 752 (Modified Outside Basis Method).Specifically, the proposed alternatives were: In Notice 2020-43, the IRS requested public comments on a proposed requirement for partnerships to use one of two methods to report partner tax capital accounts for tax years ending on or after Decem(see Tax Alert 2020-1525). On December 11, 2019, the IRS released Notice 2019-66 (see Tax Alert 2019-2184), which postponed by one year the requirement to report partners' shares of partnership capital on the tax basis method to tax years beginning on or after January 1, 2020, rather than for 2019 tax years. The 2019 Form 8865 and Schedule K-1 (Form 8865) instructions incorporated that requirement by reference to the 2019 Form 1065 instructions.ĭraft 2019 forms and instructions had proposed requiring partner tax basis capital reporting for 2019 regardless of whether a partner's tax basis capital account is positive or negative (see Tax Alerts 11). The 2019 Form 1065 and Schedule K-1 (Form 1065) instructions required partnerships to report tax basis capital account information for partners with negative tax basis capital accounts at the beginning and end of the tax year. The IRS also plans to provide transitional penalty relief for the 2020 tax year in an upcoming notice. Persons with Respect to Certain Foreign Partnerships. Similar revisions are planned for Form 8865, Return of U.S.

The IRS is accepting comments on the draft form for 30 days.

Form 1065 tax return software#

The early release of the draft instructions is intended to give tax practitioners and software providers time to prepare for the changes. The IRS plans to release the final version of the instructions in December. In a change from plans proposed by the IRS earlier this year, the instructions would require partnerships to use the "transactional approach for the tax basis method" for purposes of reporting tax capital accounts to partners on Schedule K-1 (Form 1065).

The IRS has announced the release of draft instructions for the 2020 Form 1065, U.S. Draft Form 1065 instructions would limit partnerships to one method of reporting partner tax basis capital accounts

0 kommentar(er)

0 kommentar(er)